The Initial Milling Business

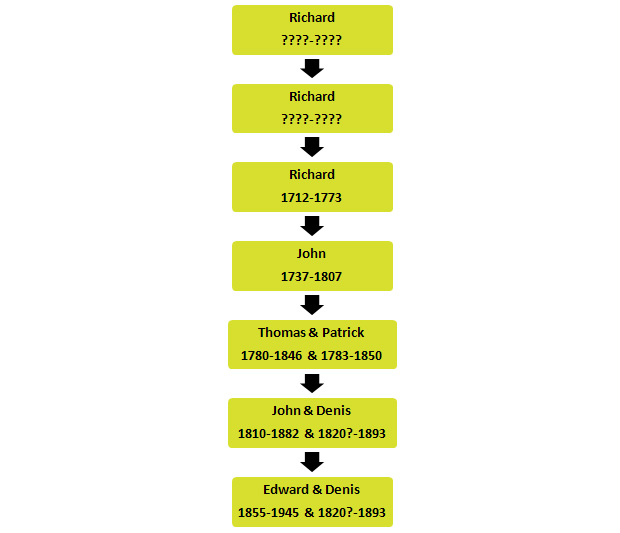

The Tinvane Dowleys were millers on the Lingaun from about 1600. It is possible that they were in the milling business earlier than that in another location in the Carrick-on-Suir area. When the Dowley mill in Tinvane was completed in the early 17th century it would have been small by comparison with later mills. However, it would have required considerable capital to build the mill and to harness the water from the river Linguan to drive the millwheel. Where the capital for this project came from is unknown and we are never likely to discover as the original Dowley owners can’t be established with certainty. The first occupier may have been the same Richard “Dowly” that is listed in the Hearth Money Rolls of 1664 or more likely his grand-father. The Dowleys were exclusively millers for the first 200 years. In the next 200 years they branched out into general trade in agricultural commodities as well as fuel and river transport.

The early establishment of the Dowley mill on the Lignaun meant that it was smaller than those constructed during the period of great expansion in the Irish milling industry towards the late 1700’s. It should also be mentioned that practically all the larger mills in the country at that time were in Protestant hands. This might be understandable given that Catholic Emancipation did not take place until 1829 which post dated the big explosion of milling in Ireland.

The middle half of the 18th century, when Richard Dowley (1713-1773) was in charge of the mill, would have been a very depressed period in Irish agriculture with little opportunity for progress in the milling industry. During this period Irish farmers increased the area under pasture at the expense of tillage12. This was due to the low cost of production together with the high price of meat and butter. Much of the output was exported. Waterford was one of the major export ports and it may be at this time that the Dowley family first became involved in the river trade.

In 1758 the Irish Parliament made its first real effort to promote tillage when the first bounties for the inland carriage of corn to Dublin were granted. This seems to have had some effect in checking the influx of British corn into Ireland. In 1767, a further bounty was given on the carriage of Irish corn by sea to Dublin. This further promoted tillage in Ireland. At the same time the English population was rising rapidly due to the industrial revolution which resulted in an increase in the demand for grain in the UK. Towards the end of the 18th century, ‘Fosters Corn Laws’ which prohibited the import of grain, were passed in Ireland and much attention was focussed on the promotion of tillage. Corn mills sprung up all over the country and the export of corn and corn products to England became increasingly profitable to all classes connected with the tillage industry and Ireland was referred to as the “bread basket” of the UK.

Carrick, by virtue of its position on the river Suir, was able to take advantage of this new opportunity. The fact that the Lignaun mill was in existence for some 150 years at this stage together with the Dowley involvement in the river trade should have conferred significant commercial advantages on the Dowley family of millers. The main beneficiaries in the revival of the corn trade would have been John Dowley (1737-1808) together with his two sons Thomas (1780-1846) and Patrick (1782-1850). In 1800 Act of Union brought Ireland and the UK under the same administration and this together with the Napoleonic wars of 1803-1815 had the effect of increasing the demand for grain.

At the beginning of the 19th century, the British Conservative Party was largely controlled by the landed gentry or aristocrats of the day. They were large producers of grain and the British Corn Laws of 1815-1846 were designed to protect British grain farmers from foreign competition. These laws not only kept prices high; they also protected against falling prices in years of plenty. At the time that John Dowley of Tinvane was born in 1810, the grain business was thriving in Ireland. In 1836, John acquired a shareholding in the newly formed Suir Navigation Company which would confirm the Dowley interest in the river trade at that time. By 1845, Irish food exports were feeding some two million of the UK population. A ban on the export of food at this time would have gone some way towards alleviating the food shortage in Ireland resulting from the first appearance of Phytophthora infestans and the failure of the potato crop. However, the laissez faire economic policy pursued by the UK Government at the time would have been very much opposed to any direct interference in commercial activity.

The industrial revolution in Britain also resulted in pressure on the Conservative government to repeal the Corn Laws to provide cheaper bread for the increasing number of industrial workers. This pressure kept mounting until it reached breaking point at the beginning of the Great Famine in Ireland. This eventually resulted in the repeal of the Corn Laws in 1846 and the fall of Sir Robert Peel’s government. This had a negative effect on the corn trade in the UK. However, in Ireland the export of grain continued for some time after 1846 as the corn growing farmer had no other means of acquiring the money with which to meet his rent to the landlord. The grain trade would have been further enhanced by the Crimean War of 1854-55. The main beneficiaries in the export of grain and grain products would have been John (1810-1882) and his first cousin, Patrick John (1812-1872). The export of grain was coupled with the import and sale of coal from the UK which was also a very lucrative enterprise. This fact is supported by Mrs Wilkinson4.

The export of grain during the famine period of 1845-1849 was politically unacceptable despite the fact that most of the people who were starving did not have money to buy it. This may have been one of the reasons why the Tinvane Dowleys were never the most popular family in Carrick.

From the foregoing it is probable that the Dowleys made a lot of money between the years 1775 and 1850 approximately. This theory would be supported by the fact that John had sufficient liquid capital to invest heavily in the newly formed Sadlier’s Bank or the Tipperary Joint Stock Bank founded by John Sadlier in 1838. The manager of the Carrick branch of this Bank in 1846 was one Clement Sadlier.

In Slater’s Commercial Directory of Carrick-on-Suir in 184613, John “Dooley” of Tinvane is mentioned as a miller while Michael Dowley (Ballyknock) of the Quay and 101 Main St. is mentioned as a corn merchant, grocer, spirit merchant, tobacconist and slate, tile and brick merchant. Ellen Dowley of 87 Main St. is mentioned as a confectioner. This is possibly the Ellen or Helena Dowley from Patrick’s family in Tinvane. While the river trade was known to be buoyant at that time, no mention is made of it in the Directory. As a result this Directory could be considered to be incomplete. There is also no mention of a Dowley in Waterford in the 1846 Directory.

The marriage settlement dated August 4th, 1879 between Edward Dowley and Ursula Mary Walsh states that while John (Edwards father) was in possession of a half share in the mill (from his father Thomas) he was also in possession of properties on the Fair Green as well as New St. It appears that John acquired these in his own right as his father’s will does not mention these properties. It is likely that this New St. premises may have been the original HQ of Edward Dowley.

John’s investment in Sadlier’s Bank was unfortunate as the Bank failed in 1856 when his son Edward was only 1 year old. This in turn could have lead to his “bankruptcy”. This seemed to be a peculiar type of bankruptcy as the following statement appeared in the Nationalist newspaper, dated September 22nd 1877.

“John Dowley, Miller, of Tinvane managed to become a creditor of several merchants on, about the year 1859, when he made himself scarce for some months after which he was able to return under the paternal care and protection of The Bankruptcy Court. He has since lived like the son of an Irish King and from his dress and gait, his son Edmund gained the soubriquet of the sham squire”.

What all this means is not clear. Whatever the implications of “bankruptcy” were in this case or at that time, John did not seem to lose any of his property which seems to have been passed on to Edward to seed his business enterprises. John Died in 1882 some two years after Edward got married.

What is difficult to understand is that the Patrick side of the family did not seem to prosper to the same extent. This may have been because this side of the family were only involved in the Tinvane mill, which may have been declining at the time, while John had the sole interest in the New St. Business as well as the more lucrative river and export trade.

The Secretary of Research at The British Flour Milling Association concluded that according to the records at their disposal, the Dowley milling interest was probably the oldest in Britain or Ireland still retained in full by the family of the original founder11.

Edward Dowley of New St.

It is not clear which of the Dowleys were the first to start trading in the town of Carrick-on-Suir but it may well have been Thomas and his brother Patrick. However, we do know that Thomas’s son John was well established in New Street and the river trade at the time of his death in 1882.

Following Edward’s abortive attempt to emigrate to America, he was sent to do what appears to be an apprenticeship in Baganalstown, Co. Carlow. After about seven years with Brown and Crostwaith, Edward returned to Carrick-on-Suir and went into business with his father, John.

His return to Carrick was followed by a period of rapid change for Edward and the Dowley business. In 1879 Edward got married and had the first of his 12 children in 1880. A year later, Patrick John (P.J.) of Waterford, who had a half share in the Tinvane Mill passed away. His only remaining son, William, also died in 1881. This would have left Denis (PJ’s younger brother) running the mill, if not with a share in the business. Denis would have been about 61 at that time, assuming he was born in 1820. A year later, Edward’s father, John, died. This would have meant that Edward, now only 27, was the senior stakeholder in the Tinvane mill as well as controlling his father’s business interests in Carrick-on-Suir and Waterford. This left young Edward in a very advantageous position.

During the 1880’s the financial position of many Landlords, including the Briscoes of Tinvane, became very difficult. At the same time Edward Dowley’s business was thriving and Henry Briscoe took out a mortgage from Edward Dowley to help finance his Estate. However, the Briscoe finances continued to decline and the Estate eventually went bankrupt.

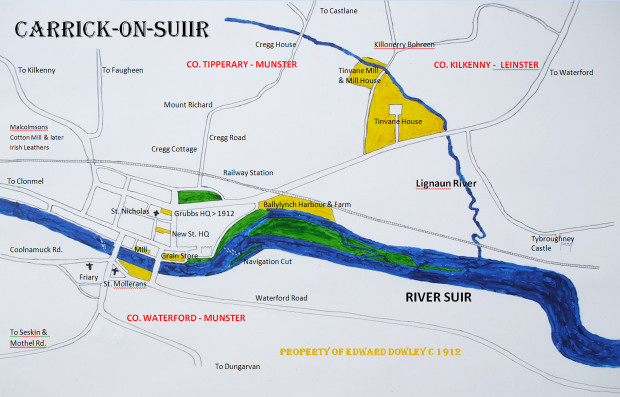

In 1891, Edward Dowley bought Tinvane House, the mills on the Lingaun together with 98 acres of land from the Briscoes for £2,900. This was done through the Irish Land Commission and was possibly a very good deal. Around the same time he also increased his property portfolio in Carrick and acquired a farm in Ballylynch.

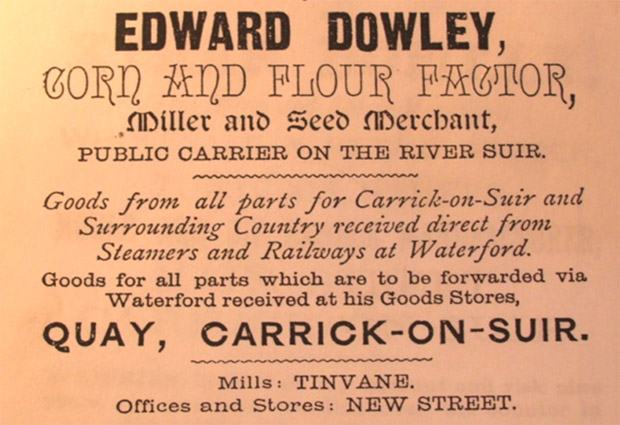

The business was continued and developed by Edward and an advertisement in the Bassetts Directory of Tipperary confirmed that in 1889, the name of the business had changed to Edward Dowley and was trading in New St., the Quay, Tinvane and Waterford.

The same Bassetts Directory of Tipperary also lists the business interests of different individuals in Carrick-on-Suir in 1889. In that year there were nine “Boat Owners” which included two Butlers of Carrickbeg, Dowley of New St, Healy of Kickham St., Howell of Suir Valley as well as Callanan, Kenny, Murphy and Grubb of the Quay. There were five “Millers & Seed Merchants” which included Dowley and Walsh of New St., Walsh of Ballynacloona, as well as Callanan and Grubb of the Quay. There were nine “Corn & Flour Merchants” which included Butler and Duggan of Carrickbeg, Calanan of the Quay, Morrissey of Kickham St., Doherty, Dowley, Grubb and two Walsh’s of New St. This would suggest that in 1889 there was no Dowley business premises at the Quay. However, the above advertisement clearly mentions the stores on the Quay at Carrick-on- Suir.

The original Head Office of Edward Dowley & Sons Ltd. in the middle of New St. which was in use up to 1912. It then became a grain store and in 1962 became the headquarters of Suirway Farm Machinery Ltd. (photo 2009).

There is no doubt that all the information from different sources would suggest that Edward was a very astute businessman and that he acquired a lot of wealth during the course of his long life. The big question is how he managed to bankroll the Briscoes and eventually buy them out within a little more than a decade after returning to Carrick from Bagenalstown.

Edward Dowley & Sons Limited

The main opposition to Edward Dowley in the Carrick area at the time was a branch of John Grubb & Sons. The Grubbs were a Quaker family from Clonmel and the Carrick-on-Suir branch was managed by J. Ernest Grubb. However, in 1906, there was a major fire and the warehouses and offices of John Grubb on the quay were destroyed. Following the fire, J. Ernest Grubb rebuilt the warehouses on the quay and acquired a property at the north end of New St. where a new head office for John Grubb & Son was built in 1907. However, Ernest suffered from asthma and his health was beginning to deteriorate.

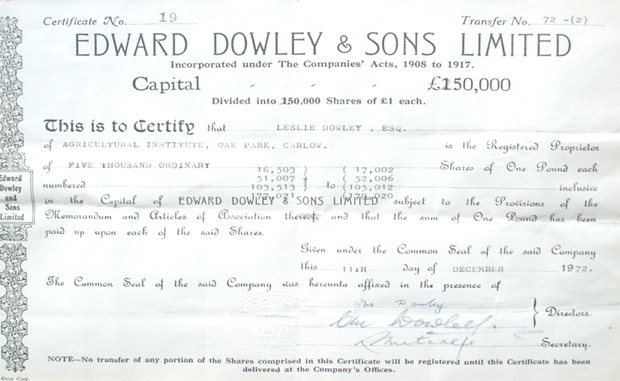

On December 16th, 1910 the Tinvane Dowley business was officially incorporated as Edward Dowley & Sons Ltd., and the first audited accounts of the new company are dated the 30th June 1911, just before the purchase of John Grubb & Son. This may have been in anticipation of a takeover of the Grubb business in Carrick. It can be seen from the Memorandum of Association dated December 14th 1910 that the share capital was £250,000 and the initial share holders were Edward and his son Milo Dowley. At this date Edward was 55 years of age and Milo was 28.

In 1912, J. Ernest Grubb eventually retired on health grounds and the entire Grubb business, with the exception of the Suir Steam Navigation Co. was acquired by Edward Dowley & Sons Ltd. The Suir Steam Navigation Co. was sold to Walsh’s of New St. The Head Office was transferred from middle New St. to the new building at the north end of New St. This remained the head office of Edward Dowley & Sons Ltd. until the business was finally sold in 1974. Part of the contract of sale to Dowleys was that the plaque bearing the inscription “J. G. & S. 1907” was not to be removed from the North gable wall. This part of the contract was strictly honoured and the inscription was still clearly visible on the wall in 2013, 101 years later. In my memory, these premises were always referred to as “Grubbs” by the Dowley family as well as the staff and most of the customers. This may have been more to distinguish the building from the other Dowley properties in New St., Ballylynch and the quay rather than to acknowledge the origins of the building. This building also became the main retail outlet for the Dowley business. In the same year the first Knocknagow was purchased followed by the second shortly afterwards. Edward did not take the opportunity of purchasing the steam tug “The Father Matthew” from the Grubb family as the Knocknagows were considered to be more suitable for the river trade between Carrick and Waterford.

The Head Office of Edward Dowley & Sons Ltd. from 1912 to 1974 (as seen in 2009). Office accommodation on left and grain, feedstuff and chemical store on right with extensive yard space for fuel at the rear of the building on the right.

The inscription on the North gable end wall of Edward Dowley & Sons indicating that the premises was originally the property of John Grubb & Sons (photo 2009).

Following the move to Grubbs, the original Head Office in New St. was used as a grain store and also as a service area for the Dowley fleet of trucks and cars. This continued until 1962 when the premises became the head office of Suirway Farm Machinery, a subsidiary of Edward Dowley & Sons Ltd.

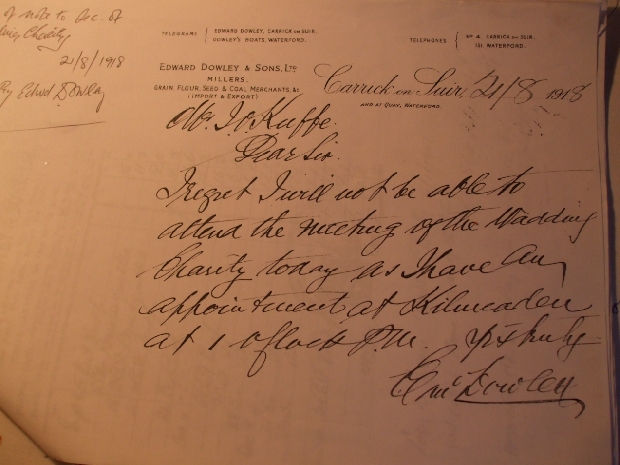

Letter to the Wadding Charity in 1918 from Edward Dowley

It can be seen from Edward Dowley’s letter to the Wadding Charity in 1918 that the company had a branch at the quay in Waterford to deal with the boating interests. It also confirms Edward Dowley’s involvement in the import/export trade at that time. The Waterford branch was probably started by Edward’s father John many years earlier as we know that he held a share in the Suir Navigation Company, started in 1836.

In 1919 Edward Dowley & Sons Ltd. sold the land in Carrickbeg to a group of farmers to build a co-operative store to sell seeds, fertilisers and farm requisites to their members. This was later (1964) to become part of Waterford Co-Op and finally it was amalgamated with Avonmore Co-Op in Kilkenny to become Glanbia PLC which was then a major player in the Irish agricultural industry and had businesses interests in a number of countries. In retrospect, the sale of the land in Carrick-beg was a strange decision as it would be the co-operative movement that would later threaten the future of the Dowley business in Carrick.

When Joseph and Willie joined the company is not known, but Joseph had spent a number of years in the Bank and Willie in the UK before joining the firm. It seems that their entry to the company followed a number of years of successful trading and a requirement for additional managers in an expanding business.

In 1927 Edward purchased the Suir Steam Navigation Co. from Walsh’s of New St. and thus became the main carrier on the river Suir. By this time the Dowleys controlled most of the commercial property at either side of the Dillon Bridge including land on the Waterford side of the river.

On the 15th of June 1928, a Form of Transfer was signed by Joseph Ignatius Dowley of Castlane, Carrick-on-Suir, Co. Kilkenny, Corn Merchant and Edward Dowley of Tinvane in the County Tipperary, Corn Merchant. This document was witnessed by Michael JON Quirk, Solicitors, Carrick-on-Suir. The document confirmed that J. I. Dowley bought 4,666 shares in Edward Dowley & Sons Ltd. from Edward Dowley for £4,666. It is assumed that Willie entered into a similar transfer. At this date, Edward was 73 years of age while Joseph was 41 and Willie was 36. On the surface this seems a bit strange as Joseph and Willie were with the firm for many years at this time, although it must be said the limited company was only in existence for not more than 18 years at that time.

It may be that Edward wanted to divest himself of all his shareholding in the company when he reached 73 years of age. It is not known if he intended to retire at this time and if the financial exchange formed a type of pension. However, it is known that he kept an office in Grubbs and attended for some time on a daily basis for many years after 1928. Edward survived until 1945, but may not have been physically active much later than 1940.

A meeting of the Blueshirts in the early 1930’s with the Dowley HQ in the background right

In the first quarter of the 20th century, Edward also bought expensive houses and land for many of his children confirming that he had accumulated a great deal of wealth during the late 1800’s and early 1900’s. From my memory the Tinvane Dowleys would have always been considered to be very wealthy and somewhat aristocratic. The trappings of wealth would have included successful business enterprises, company directorships, extensive farm lands, impressive residences, expensive automobiles as well as the best education for the children, in Ireland, the UK and the continent. My own recollections would confirm that Edward and all his children that remained in the Carrick-on-Suir area were very well off. The question now arises as to over what period, and how this wealth was accumulated. The answer to this question must be largely a matter of conjecture combined with family memories and historical opportunity as well as the financial accounts that are still available to-day.

The mill on the quay at Carrick-on-Suir produced flour as well as compounded animal feeds for cattle, cows, pigs, poultry, horses and sheep. Over the years, more and more of the wheat was transferred by boat to the Waterford Flour Mills for milling. This resulted in a reduction in flour milling and an increase in the production of animal rations. The grain drying was carried out in the premises below Dillon Bridge while the fertilizer compounding as well as the seed assembly was carried out at Ballylynch.

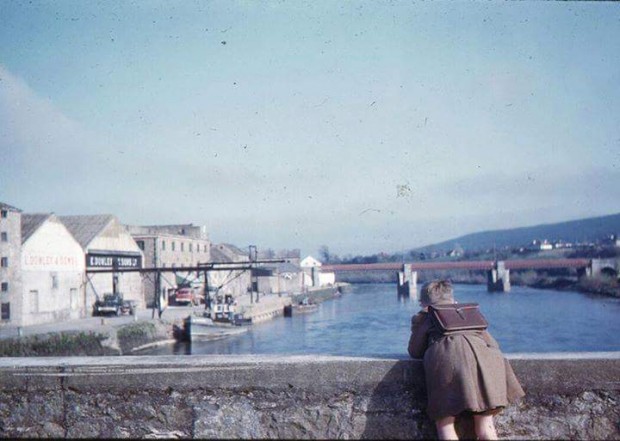

Dowley mills and the small Knocknagow on the North bank of the Suir

The Dowley Mills pictured from the Waterford bank of the Suir

Interior of the Dowley mill at the quay, Carrick-on-Suir

Loft of the Dowley mill at the quay, Carrick-on-Suir

The Dowley Mill on the quay with gantry, Knocknagow 1 and a lighter beside

The north quay east of Dillon Bridge where the grain drying facilities were located (including Unicast to the right (photo 2009).

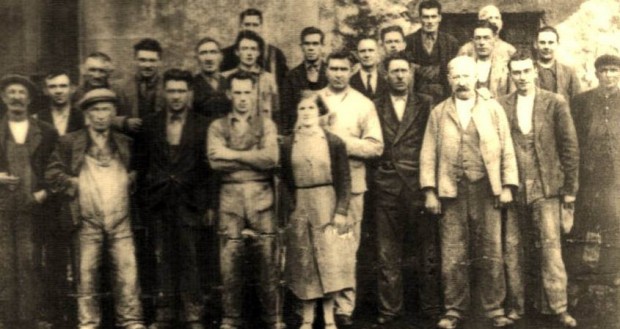

Dowley workers on the quay around 1950. Mick O’Dwyer 4th from left in back row and Jimmy Jaques on extreme right. The others I cant identify definitely but include Michael Shanahan, Jeff Wells, Sammy Casey, Harry Shanahan, John Keating, Michael Dowley, John Murphy, John Waters, Richard O’Neill, Tom Sweeney, Jack Torpey, Magie Doherty, Johnny Casey, Jackie Norris, George Power and Johnny McGuire.

Edward Dowley & Sons Ltd. after Edward

By the late 1930’s the third generation started to join the company in the form of Edward and Cecil Dowley and later Donald and Kevin. They became junior directors while Edward, Milo, Joe and Willie were senior directors.

William Dowley became the Managing Director following Edward’s retirement. Under his stewardship there came the period of greatest expansion and diversification. Branches were opened in Cashel (1940), Clonmel (1941) and Callan (1959). The late fifties also saw Dowleys and Staffords of Wexford combine with Royal Dutch Shell to open the Albatross fertilizer factory in New Ross. Diversification into the car and farm machinery business came a little later when Suirway Farm Machinery was opened in Carrick in 1962 and Cartrac in Thurles in 1966. The Dowley fleet of boats was also increased around this time with the addition of the New Forge, the Rocksand and the cement barges. Due to the involvement with the river traffic there was a branch and warehouses on the south bank of the Suir in Waterford from a much earlier stage.

In the 1950’s the salaries of the senior directors were more than double that of the junior directors. At the same time the dividend per share was high. This was probably a more tax effective arrangement at the time. However, the shareholding of the senior directors was four times greater than the junior directors. As a result, there would have been a huge difference in total income between senior and junior directors. This was further aggravated by the fact that senior directors were given new cars while their old ones were passed on to the junior directors. All of this seemed to create a state of animosity between the two groups of directors. This would not have been good for the business as a whole, especially if the junior directors were finding it difficult to make ends meet.

The junior Dowley directors would meet regularly after work in Pike’s Hotel on Main St. to complain about their plight and hatch plans to improve their situation. The more alcohol that was consumed the more revolutionary they became, but this Dutch courage rarely resulted in positive action. To what extent these activities distracted them from further developing and diversifying the business can not be quantified. The problem was in part due to the strict hierarchical system of the time and the autocratic attitude of the senior directors. There also seemed to be a lack of agreement regarding the future development of the company. These problems would not have augured well for the future of the company.

Around this time Irish agricultural production was increasing rapidly and the Co-Ops such as Waterford and Avonmore were becoming major players in the areas traditionally serviced by Edward Dowley & Sons Ltd. The traditional agricultural merchants such as Dowleys found that their business was reducing and their profit margins were being squeezed. The future now seemed to be uncertain.

Standing: Danny Carroll, Charlie Steel, John Lyons, Paddy Butler, Dick Joy, Neddie McGrath?, Edric Dowley, Billy O’Neill, Brendan Cleary, Michael O’Dwyer

Seated: Kevin Dowley, Edward Dowley, William Dowley, Cecil Dowley, Donald Dowley, Willie Morrissey

Some of the large crowd at the Dowley Social (circa Christmas 1960)

DIRECTORS OF EDWARD DOWLEY & SONS LTD. 1962

William Morrissey, Kevin Dowley, Donald Dowley

Cecil Dowley, William Dowley (MD), Edward Dowley, Joseph Dowley

During the late 1950’s Edward Dowley & Sons Ltd. began to hold an annual Dowley Christmas party in the Ormonde Hall in Carrick-on-Suir (now a supermarket). This was attended by the company staff and their families. The photo above gives some idea of the large number staff employed by Edward Dowley & Sons Ltd. At that time there were some 150 staff with 17 lorries on the road and 6 boats on the river.

Noreen Dowley, Eileen Dowley and Donald Dowley at Dowley Social circa 1962

In 1962, promoted by Willie Morrissey, the company diversified into the car and tractor sales at their original head office in New St. following the establishment of Suirway Farm Machinery. Apart from being agents for Massey Ferguson they were also main agents for BMC cars such as Morris, Riley and Wolsley. The business was a subsidiary of Edward Dowley and Sons Ltd. and went from strength to strength under the directorship of William Morrissey (MD) and Edward Dowley (Dow). In 1966 a similar company, Cartrack, was opened in Thurles which was managed by Mr. Luke Aherne. In the next eight years the profits from these two subsidiaries contributed significantly to the overall performance of the parent company.

In 1963 my father (Edward Dowley) died when I was 21 and in my final year of a B.Agr.Sc. degree in UCD. Following graduation, I began accountancy with a view to joining the staff of Edward Dowley & Sons Ltd. Having inherited my father’s shares I was then a minor share holder but not a director of E. D. & S. The directors were Willie, Joe, Cecil, Donald and Kevin Dowley together with Willie Morrissey and Raymond Metcalfe (Secretary).

In 1964 I joined the staff of The Agricultural Institute at Oak Park, Carlow as a research scientist in potato breeding and genetics. My initial intention was to spend a few years in research before returning to Edward Dowley & Sons Lid. However, five years later I was married with three children. This tended to concentrate the mind on security rather than uncertainty. Had my father survived longer and did not have an alcohol problem I would have undoubtedly returned to work in the family business. During the period 1964 to 1970 I would have on occasions discussed the possibility of joining the staff of Edward Dowley and Sons Ltd with my grandfather, Joe. At no time can I recall him encouraging such a course of action, in fact the opposite tended to be his considered opinion. His prognosis for the future of the company seemed to be anything but confident.

A letter to me from the Secretary of Edward Dowley & Sons Ltd. (Raymond Metcalfe) dated 19th June 1970, confirmed that my grandfather (Joseph I. Dowley) had tendered his resignation as a director to a meeting of the Board of Directors dated the 9th of June 1970. The reason for his resignation is not stated but it can be assumed that it was on the grounds of ill health as he died on the 4th of February 1971. At the same meeting I was co-opted to the Board of Directors of Edward Dowley and Sons Ltd. to fill the vacancy caused by my grandfathers resignation. I would have attended one meeting of the Board prior to my departure on sabbatical leave to the University of New Hampshire, USA.

From this meeting I learned that while the business was making annual profits, it would have made infinitely more money by renting its vast property portfolio in three counties. On top of this, none of the younger Dowley directors had a University qualification and they also lacked the necessary entrepreneurial skills to take the company forward in the face of the current competition. This would have made future management of the company difficult if not impossible in the absence of the then managing director William Dowley. Willie, while over 70 at the time, was a very astute business man and was effectively keeping the company going on his own. There was also the fact that none of the other Dowley directors had descendants that would join the company. This would mean that over time, the ownership of the company would be in the hands of many people unrelated to the business. This would have serious implications for the future management of the company. These facts prompted me to inform the MD that I would not be joining the staff of Edward Dowley & Sons Ltd. now, or at any time in the future. What effect my decision had on the final decision to liquidate the company, if any, I really don’t know as I was on sabbatical leave at the University of New Hampshire in the USA during this period. I suspect that the decision to sell was based solely on commercial reasons as well as personal considerations of the other directors.

In May 1974 I was summoned back to Ireland to attend what effectively was the last and most important directors meeting of Edward Dowley & Sons Ltd. The purpose of this meeting was to approve the sale of the company to Suttons of Cork which was then a subsidiary of Eagle Star Ltd. in the UK. Nickerson’s Plant Breeding (UK) was also a subsidiary of Eagle Star and required extra outlets in Ireland for their rapidly increasing range of new cereal varieties. According to the report of the directors dated the 31st May 1974, the directors of Edward Dowley & Sons Ltd at that time were; William S. Dowley (MD), Cecil M. Dowley, W. R. Donald Dowley, Kevin A. Dowley, Leslie J. Dowley, William Morrissey, Anthony J. Mullins and Raymond Metcalfe.

William Dowley must have been working hard on the disposal of the company for some time prior to the sale. His many business connections and company directorships including the National Bank (now BOI) would have been invaluable in locating potential buyers. His proposal was to sell all the assets of Edward Dowley & Sons Ltd. with the exception of the shares in Odlums. This proposal was regretted but accepted by all the directors. William Dowley died some six months later.

In retrospect, the decision to sell was probably the right one as the only agricultural merchants in existence in 2010 are either much smaller or much larger than Edward Dowley and Sons Ltd. The larger ones were controlled by multinational companies such as Glanbia. To compete, E.D. & S. would have had to expand and diversify and to employ highly qualified and experienced executives. I suspect that this alternative was neither affordable or acceptable at the time. Even if this option was considered it would have been accompanied by a risk that may not have been acceptable.

As Odlums was a private company, the shares in this company had to remain in Dowley hands. As a result the shares were vested in a holding company called Caymen Investments. This was not an off-shore company, but the name was a strange one in view of the bad reputation of off-shore investments at the time. The initial directors of this company were William Dowley and Cecil Dowley. Following the death of William (1974) and Cecil Dowley in 1986, Donald Dowley was appointed secretary and the other director appointed was Leslie Dowley. During the 1980’s and 1990’s the Odlum shares performed well and Caymen accumulated a number of other investments. Irish Sugar or Greencore PLC eventually acquired all the share capital in Odlums. The price paid for the Odlum shares held by Caymen was similar to the price paid by Suttons of Cork to acquire the whole of Edward Dowley and Sons Ltd. (This may put into perspective the value of Edward Dowley & Sons Ltd at the time it was sold). The compulsory sale of the shares in Odlums made Caymen Investmets cash rich. This, together with a major change in Capital Gains Tax from 40% to 20% resulted in the liquidation of Caymen Investments in 1998.

Both Joe and Willie were also the owners of holding companies called Castlane Ltd and Tinvane Ltd respectively. These companies held their respective share holdings in Edward Dowley & Sons Ltd. as well as most of their other share assets. The introduction of wealth tax necessitated the liquidation of these companies.

The liquidation of the different companies associated with Edward Dowley & Sons Ltd. took a long time and was associated with serious professional costs and tax payments which in turn significantly reduced the original sale price of Edward Dowley & Sons Ltd. which according to Robert & Douglas Dowley (Chartered Accountants) was very low in the first place.

Profitability of Edward Dowley & Sons Ltd.

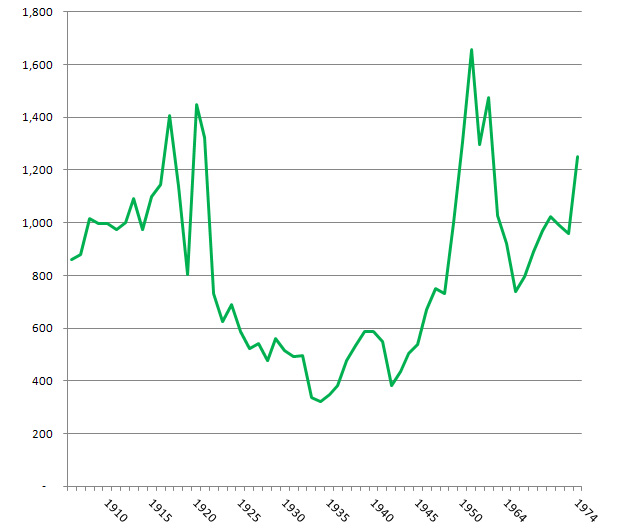

Thanks to Edric and Milada Dowley of Graigue House, the audited accounts of Edward Dowley & Sons Ltd. were saved from destruction following the sale of the company in 1974. These are continuous from 1906 to 1953 with two more for 1961 and 1964 and still more from 1970-1974. Further scanty details are available for 1967-1969.

The annual audit was carried out by Mr. Sandy O’Sullivan of McCathy, Daly, Stapleton of the South Mall, Cork, later to become Cooper & Lybrand. The audited accounts of Edward Dowley & Sons Ltd. for the early part of the 20th century outlines the various commodities in which the company traded. These included Maize, Flour, Oats, Pollard, Bran, Wheat, Feeding Stuffs, Seeds & Manures, Coal and River Transport. The main commodities were Maize meal followed by Flour, Oats, Pollard and River Transport. This would suggest that the company was very simple business model, which manufactured or bought agricultural commodities which they subsequently sold for a profit.

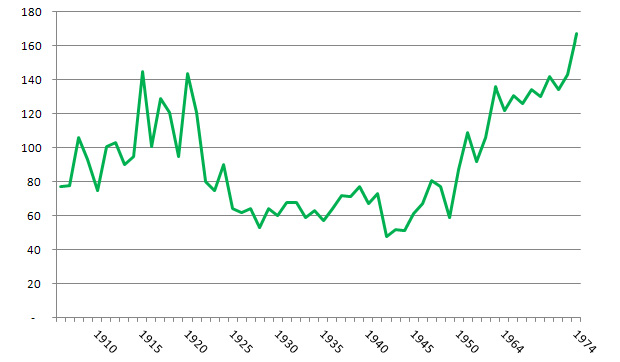

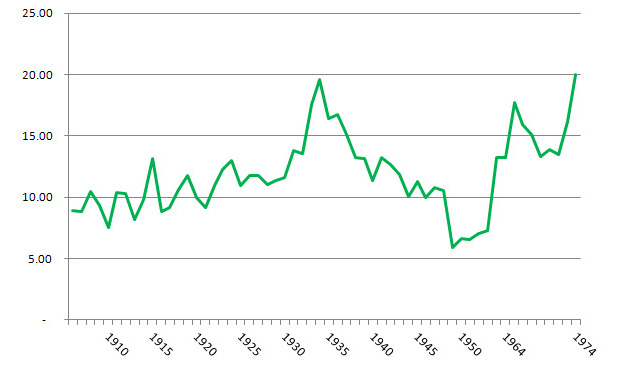

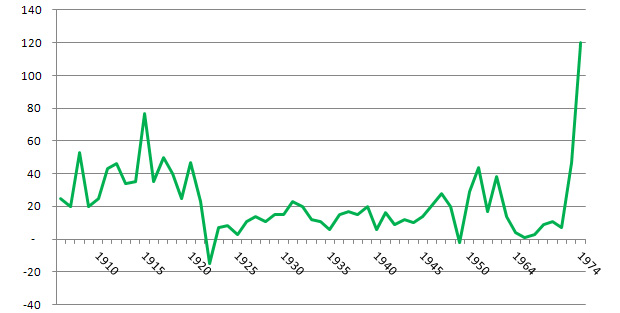

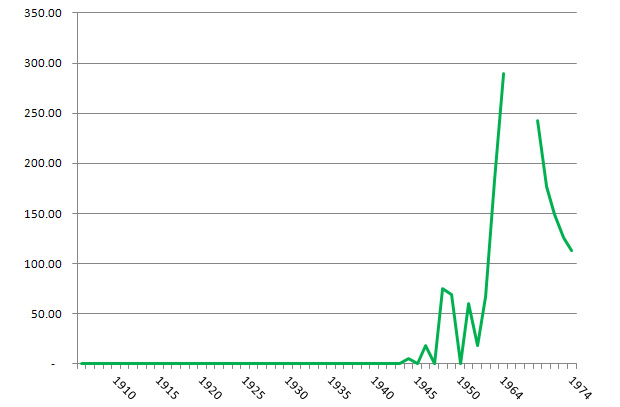

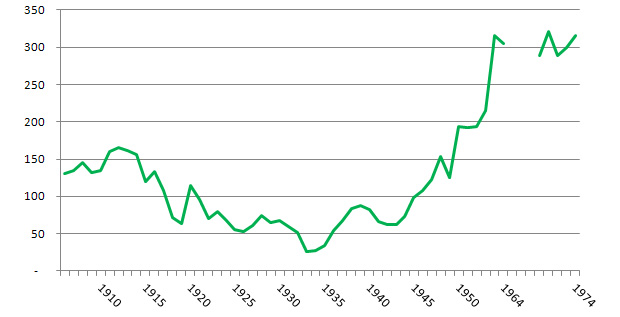

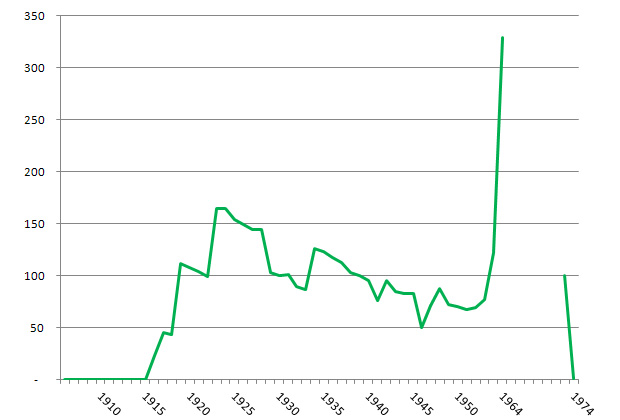

Audited accounts are available for all years except 1954-1960, 1962-1963 and 1965 to 1966. The actual figures for sales, gross profit, % gross profit, net profit, bank overdraft, sundry debtors and investments are given separately. These figures are also adjusted to 1974 values. The adjustment was achieved by using the formula AV=PV(1+0.036)n where AV equals the adjusted value, PV equals the present value and n equals the number of years between the year in question and 1974. This formula was suggested by the Economics and Social Research Institute (ESRI) and is based on an average inflation rate of 3.6%. For ease of visual comparison the adjusted figures are also given in graphic format.

The audited accounts were also examined in detail by my two sons, Robert and Douglas Dowley, both of whom are qualified chartered accountants. Their valuable comments are included below.

Of course the business was affected by the historical events of the time and these must be kept in mind when looking at the financial accounts for the period in question. It is not my intention to give a detailed history of the period from 1905 to 1974, however, certain important events must be mentioned. Good trading conditions would have existed in the early years of the 20th century. The Easter Rising of 1916 was followed by the Irish Civil War of 1922-1923. The latter event would have had a serious detrimental effect on Irish agriculture but the effect of the Economic War with Britain (1933-1938) would have been even more serious. This in turn was followed by the Second World War 1939-1945. It was not until after the war that there was a general improvement in Irish agricultural and in the Dowley trading position. However, in 1949 there was a major fire in the Dowley warehouses on the quay in Carrick and this had a negative effect on the business for a period.

Other important aspects of the Dowley business were the trade debtors and the date of the annual audit of the end of May. Normal practice dictated that the customers purchased seed and fertiliser in the Spring but did not pay for them until the Autumn when they delivered the produce back to Dowleys for drying and processing.

Dowley Trade 1900-1920

During this period, Edward was in his prime, and the sales were very buoyant (Fig 2). Gross profit was also high (Fig.3) while gross profit % averaged about 10% (Fig.4). Coupled with this, the net profit per year was around £50,000 (Fig. 5), there was no bank overdraft (Fig. 6) and the trade debtors were in the region of £150,000 reflecting the high level of sales (Fig. 7). It was also during this period that the company used some of its surplus cash to make judicious investments in other companies (Fig.8).

This was a very profitable period for the company and would confirm that Edward was a formidable businessman and an excellent manager. It was also during this period that Joe and Willie Dowley joined the management team of Edward Dowley & Sons Ltd. This would be further confirmation of the expanding nature of the business at this time.

Dowley Trade 1921-1950

It was during this period that we had the Civil War, the Economic War, the Second World War and the fire on the Quay. There were also a number of strikes during these years and in general trading conditions were difficult to say the least. Despite these trading difficulties the company made a profit each year except 1921 and 1949. These were the years of the Civil War and the fire. Towards the end of the 1930’s the next generation joined the company in the person of Cecil, Edward (Dow) and Donald Dowley.

The comments of Robert Dowley (B.C.L, ACA) and Douglas Dowley (B. Com., ACA) on this period are as follows:-

The pattern of the company’s profit and loss/balance sheet was such that it displayed all of the characteristics of a conservatively managed business which was producing unspectacular, but steady and reasonable profits from its core businesses, and being able to generate positive cash flow from the businesses such that they continuously added to their cash balances, and investments over that period.

In broad measure, that period involved little or no Bank debt, and also little investment in fixed assets, and therefore one must assume that either the foundations for the business were more than adequately established in the 1920’s (hence no need to make substantial acquisitions in terms of plant, machinery or land and buildings) or the business focus was to conservatively manage the company such that cash was not unnecessarily spent in that period. In all probability, there was an element of both involved.

Dowley Trade 1951-1974

The position in the company changed substantially during this period, when there was a clear and substantial increase in turnover, which put pressure on the cash flow management within the business, as would be expected. The increase in turnover could be associated with the new branches in Clonmel and Cashel coming on-stream. It is clear from the accounts that the amount of working capital involved in the business (which is a sum of the receivables, cash balances, and creditors/Bank overdrafts) increased substantially in that period, and what was previously a conservatively run company began to run a fairly consistent ‘core’ level of Bank overdraft, at least so far as the accounting year end is concerned. Obviously, the nature of the business would have meant that at certain times of the year there would have been a large amount of money invested with customers, and one could expect that in an agricultural business, the use of 31 May year end might have partially led to a high level of working capital invested at year end. That said, year on year, the same accounting year end is used, and certain trends can be extrapolated from same.

The little we know of the agricultural business in the 1950’s and early 60’s, suggests that this was not a particularly strong and profitable period for anyone in the sector and indeed a lot of agricultural changes, including the rise of the co–operative movement, began around that period of time. Naturally those types of developments would not necessarily have been helpful to existing historic participants in this industry. That is not to say that good businesses did not flourish at the time, but to do so required very strong and able employees and directors, and it is not clear to us that the collective board of directors of the company, at that time, could be so described.

That said, in the accounts we have seen, the group always made a profit, so the directors were doing something right. It is a pity that we do not have the accounts from 1953 through to 1966, as that may have established an industry backdrop against which further comment could be made.

The accounts from 1968 through to 1974 are very instructive, as are the ‘heads of agreement’ in respect of the sale of the company in 1974. In particular, one could make the following comments:

Throughout this period, the company was able to steadily grow its total level of turnover, and particularly made a significant increase in its turnover in the year to 31 May 1974.

Throughout that period, the operating costs, and gross margins remained reasonably consistent (bar the substantial increase in 1974) and therefore the inherent profitability of the company increased, as turnover increased. This is typically the ‘ideal scenario’ for business, as any time you can control costs and increase gross margins the benefit falls straight to the bottom line. Quite why the company was able to do this in that period, and not in years prior to that is not clear.

In those years, the company appears to have been prudently managed, with Bank debt reducing, and some reduction in the level of trade receivables, and trade creditors. Therefore, the level of Bank overdraft reduced in that period.

Capital gains tax was introduced in 1975, and its pending introduction may have caused the sale of the company’s investments in 1974 i.e. to avoid CGT on disposal. What is unclear from the accounts is why the proceeds of disposal are not shown up in cash on the balance sheet of the company, but rather are shown as part of ‘holding company’ on the company’s balance sheet at 1974. I think we need to get behind this. It would not surprise me if either the investments (at their market value) or the cash from the sale of the investments were channelled out of the company before the introduction of capital gains tax, in order to reduce the net assets in the company before Suttons acquired it for £475,000. But we are missing information in order to determine whether this is the case.

If these assets did not leave the company, then I am at a loss to understand how a company which had net assets (before revaluing land and buildings etc.) of £643,000 would have been sold for £475,000. I am much less at a loss if it is the case that £298,000 had already found its way out of the company, in a tax efficient form (prior to the introduction of capital gains tax) as this would have meant that Suttons bought the business on an effective multiple of profits before tax of 4, and profits after tax of approximately 8.

You will have noticed that the tax charge in the accounts to 31 May 1974 was approximately 50%, while the tax charge in 1973 accounts was much less as a percentage profit. This reflects the state of play in the Irish economy at the time, where corporation tax/income tax rates had increased significantly, and this was going to be a feature of the commercial landscape going forward from that date.

I note that our father (Leslie Dowley) mentioned that there was a further disbursement in respect of the Odlums shareholdings, and that might be something that is worth investigating further also. Perhaps some of the investments found their way into this company, so that Edward Dowley & Sons Ltd. could have been sold with approximately £298,000 less in value in it — again I think this makes sense, given that the only reason that the net assets of the company moved from the 1973 value to the 1974 value was primarily due to the realised gain on the investments, the detail of which was not provided in the accounting information secured from that time.

No doubt it is of general interest to know how the board of directors managed to improve the company’s fortunes so strongly in the period coming up to the sale of the business, and it does raise questions as to why they would have sold the business at all if they have turned it around so much. There is the question of whether they sold out the business at undervalue, when one takes into account all of the substantial fixed assets, including land and buildings that the company had at the time. Perhaps the financial position of the shareholders, and perhaps the pending introduction of both Capital Gains Tax in 1975, and Capital Acquisitions Tax in 1976 accelerated the desire to convert their interest in the business to cash in advance. This concludes the comments of both Robert and Douglas

The only high ranking staff member of Edward Dowley & Sons Ltd. still alive is Mr. John Shelley who was the agricultural adviser for the company. As I was studying for a B.Agr.Sc. degree at the time, I became very friendly with Mr. Shelley and he was eventually to act as my best man when I got married in 1966. He was a man of great ability and had a great insight into the agricultural industry. Being so close to the company business his assessment of its profitability would be invaluable. Following the closure of Edward Dowley and Sons Ltd. John became a successful auctioneer in Carrick.

At a meeting with Mr. Shelley on February 4th, 2010 he informed me that the agricultural business of Edward Dowley & Sons Ltd. took a down turn in the mid-1960’s and never recovered. He also suggested that the younger directors were not effective businessmen. This comment was also supported by Mrs. Milada Dowley. The reason for this down turn in business was not discussed, but was probably due to the pressure from the bigger Co-Ops. It is interesting to note that at that time the Co-Ops were not liable to the 5% turnover tax which was the fore-runner of value added tax (VAT). This facility to the Co-Ops was withdrawn by the Minister for Finance (Mr. Richie Ryan) – otherwise known as the Minister for Hardship – in 1975.

OTHER DOWLEY BUSINESS INTERESTS

In the early days, all the different Dowleys families seemed to be involved in farming. This is largely true right up to the present day although there were many involved in different trades and professions. Where a business was started, it nearly always had some direct or indirect involvement with agriculture.

The Connawarrie and Beech Farm Dowleys remained exclusively farmers although John Dowley of the Connawarries became chairman of Waterford Co-op as well as being chairman of the UDC.

Kyran Dowley Ltd

The Dowleys up-market grocery and bar business was started by Michael Dowley (Ballyknock) at 101 Main St. in 1821. It was continued by the Ballyknock Dowleys until the mid 1940’s when Breeth Dowley and Josephine Johns were the last proprietors of Kyran Dowleys. These two ladies were affectionately known as Bee and Wasp. The business was then acquired by the Tinvane Dowleys and continued as an up-market grocery provider.

It appears from minutes of the Company provided by Milada Dowley that the business was acquired from Beeth Dowley (Ballyknock) in late 1946 and that Kyran Dowley Ltd was formed about the same time. From the audited accounts of 1949 the price paid seems to have been around £5,000. The first Chairman was Joseph I. Dowley and the share holders and their share holding were as follows:-

- Joseph I. Dowley, 1,001

- William S. Dowley, 1,001

- Myles E. Dowley, 1,000

- Francis M. Dowley, 1,000

- Edward J. Dowley, 1,000

- Michael J. O’N Quirk, 1,000

The shares were fully paid up and the price paid per share was £1.00

Why these six Tinvane Dowleys bought a small grocery/bar business from the Ballyknock Dowleys is a complete mystery. This is especially true when you consider that none of the six had any experience in this type of business and that one (Edward) resided in the UK and Francis had just returned from India. The problem is further compounded by the fact that it did not appear to be a very profitable business.

The audit for this new company was for the year end of June 30th which coincided with that of Edward Dowley & Sons Ltd. and was conducted by the same auditors, Stapleton & Company, Trinity Chambers, Cork. Audited figures for a number of years are available. The net profit 1948 was £205 and 1949 was £393 with a letter from Stapleton suggesting that the % gross profit was too low. The net profit for 1952 was £233, 1954 was £13 and 1955 was £76. The company paid a dividend of 5% of share capital free of tax (£300) for all years from the 30th of June 1947.

This caused a problem as the dividends plus tax were higher than the profit earned. As a result, in 1955, Stapleton issued a letter warning of deficit assets and advising no dividend. In 1956 there was a net profit of €1,069 and no dividend was issued. No later audits were available to me but I understand the situation did not improve and the company was wound up in the mid 1960’s.

The fact that the gross profit was too low, indicated that there was little or no management of the company. The continued payment of a dividend to the share holders could be considered to be irresponsible or at best suggested a lack of understanding of the accounts as presented by the auditors.

I can recall the last two managers which were Paddy O’Farrell and Michael White. It did not help when the former left to run his own grocery business on the opposite side of the street. Betty Tyndall and Sheelagh Dowley sometimes helped out by checking the books.

The four story property of Kyran Dowleys to the right of the Town Clock (2009), building to left was originally the residence of Dr. Creagh, Bishop of Waterford & Lismore

Bridge St., Carrick-on-Suir with Kyran Dowleys (in yellow & Grey) in Main St.

The last Ballyknock Dowleys to own Kyran Dowleys of Main St. From Left: May Smith (nee Dowley) Breeth Dowley, Josephine Johns (nee Dowley), Betty Wilkinson (nee Smith) and Edith Dowley (Michaels daughter) pictured at Ard Cregg, circa 1950

Suirway Farm Machinery Ltd.

Dowleys entered the car and machinery business in 1962 with the opening of Suirway Farm Machinery Ltd. in the old New St. Head Quarters. They were main agents for BMC cars and Massey Ferguson tractors. Cartrac Ltd. was opened in Thurles in 1966 where they sold the Massey Ferguson range of farm machinery as well as Fiat cars. The manager was Luke Aherne and the initial directors of both companies were William Morrissey (MD) and Edward G. Dowley. Both companies were hugely successful and contributed significantly to the overall profitability of the Dowley business.

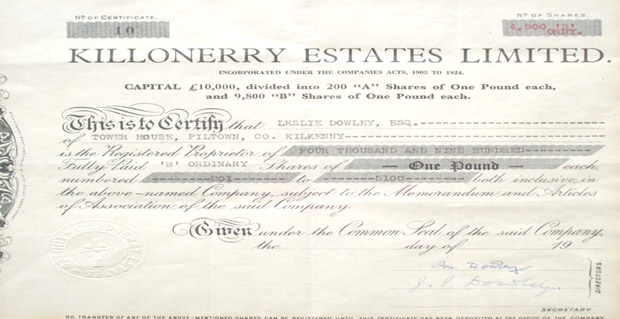

Killonerry Estates Ltd.

Killonerry Estates Ltd. was the farming arm of the Dowley business. Their farms included Rath in Co. Waterford, Ballydine in Co. Tipperary and Killonerry in Co. Kilkenny. The farm at Killonerry was purchased from the Prendergast family about 1946. The Carroll farm at Corrduff in Co. Waterford was also taken on a long-term lease. Corrduff was owned by Jim Carroll of Lock St., who was practicing as a barrister in Dublin. He was married to Twinny Quirk who was a grand-daughter of Edward Dowley. Killonerry Estates also took con-acre on many other farms. The main enterprises were cereals and sugar-beet with a large pig unit at Killonerry. There were three full time employees as well as seasonal farm help. Frank Hickey and Jim Galvin were involved in the tillage operations, while Jack Cooke was the manager of the pig unit. Jack lived on the Killonerry farm and had 22 children. JID often remarked that none of the pigs produced bigger litters.

The directors and sole share holders were Joe and Willie Dowley and it was run totally separately to Edward Dowley & Sons Ltd., at least in theory. This caused a certain level of dissention between the Killonerry directors and the other directors of E. D. & S. The latter claimed that Killonerry got preferential treatment and did not pay the full cost for supplies, especially pig feed. The former claimed that their machinery was used free of charge to harvest the crops of defaulters for E. D. & S. It was a difficult argument but as usual the senior directors of E .D. & S. (owners of Killonerry Estates Ltd.) won out.

Audited accounts of Killonerry Estates Ltd. for the 4 years end June 30th, 1953, 1957, 1958 and 1959 are available. These accounts show a net profit of £58, £2,291, £575 and -£1,272 respectively. These figures are before the payment of any Directors remuneration or dividends. From the foregoing it can be seen that the farming enterprise was more of a hobby than a money making exercise.

Following the death of Willie and Joe Dowley in the early 1970’s the company passed to Kevin and Leslie Dowley. However, it was soon apparent that Killonerry Estates Ltd. were carrying huge losses mainly due to losses on the pig unit (from virus pneumonia) but also because of the huge distances between the land areas and the lack of modern and intensive production methods. As a result, Ballydine was initially sold to reduce bank borrowings. However, the interest payments were still higher than the profits and this eventually required the sale of all the remaining land.

Albatross Fertilizers Ltd.

In the early 1950’s, Royal Dutch Shell in conjunction with Edward Dowley & Sons Ltd. and Staffords of Wexford built a fertiliser factory in New Ross known as Albatross Fertilisers. This came on stream at the time of the introduction of compound fertilisers and the big increase in fertiliser use in Ireland. Willie and Edward (Dow) were the Dowley Directors on the Board. This meant that the fertiliser trade became a big part of the Dowley business up to 1974 when the business was finally sold to Suttons of Cork. Dowley boats could bring fertilizer direct to Carrick from New Ross.

Limited audited accounts for the three years 1957, 1962 and 1963 would suggest that this business was doing well with net profits of £28,000, £32,000 and £53,000 respectively.

Plunder & Pollack (Ireland) Ltd. – Irish Leathers

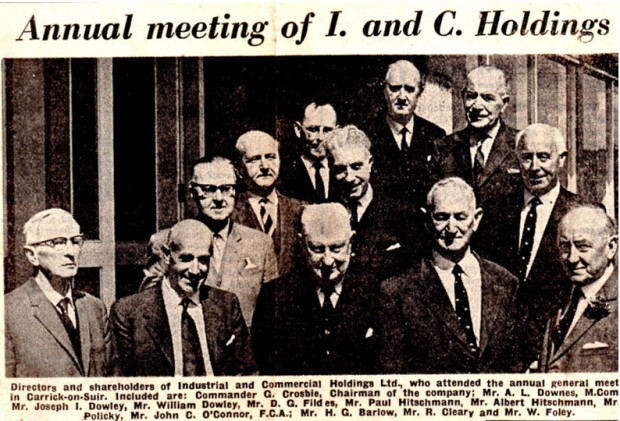

In 1938 the tannery in Carrick-on-Suir was opened under the name of Plunder & Pollack (Ireland) Ltd. It later changed to Industrial & Commercial Holdings and finally to Irish Leathers. The first directors were Fred Hitschmann, R. Hitschmann, George Dwyer of Cork, E. Rohan of Midleton, Jack O’Connor, an accountant from Cork, Commander George Crosbie of the Cork Examiner together with Joseph Dowley (Secretary) and Willian Dowley of Carrick-on-Suir. The Managing Director was Fred Hitschmann who was a Czechoslovakian Jew who fled Europe ahead of the Nazi occupation. In 1941 the tannery employed 250 people in Carrick and had an interest in tanneries in New Ross and Ballytore, Co. Kildare.

Plunder and Pollack continued to do well into the 1960’s and at that time bought the Imperial Hotel on the South Mall in Cork as well as the Southern Lake Hotel in Waterville, Co. Kerry. This necessitated some very pleasant holidays in Waterville where Joe and myself spent every day in competition to see who would catch the biggest sea trout. Above is newspaper photo of some of the shareholders and directors at the1967 AGM in Carrick-on-Suir.

In the 1960’s a further synthetic company called Feresflex was opened in Carrick and Cecil Tyndall (Joe’s son in-law) was appointed Managing Director. This was a subsidiary of Plunder & Pollack (Ireland) Ltd.

In the 1960’s there was also an amalgamation of the four leather factories in Carrick, Portlaw, Gorey and Dungarvan into the new publically quoted company Irish Leathers Ltd. The headquarters was in the old Malcolmson premises in Portlaw. This amalgamation resulted in continued prosperity for the leather industry. However, Joe Dowley died in 1971 and William Dowley in 1974. By the late 1970’s cheap leather from South America heralded the demise of Irish Leathers. In 1985 they went into receivership and the shareholders eventually received nothing. As a coincidence, one of the directors of Irish Leathers at that time was Joe Dowley’s great-grand daughter’s father-in-law, the late James Oliver of Carlow.

The New Suirway Farm Machinery

I returned from study leave in the USA in August 1974. At the time I was married with five children and the sale of Edward Dowley & Sons Ltd. was completed. My father in-law, Willie Morrissey, had been a director of Edward Dowley & Sons Ltd. and was currently on the board of the new company, where he still had responsibility for the farm machinery part of the business. We were both aware that Suttons of Cork were only interested in the cereal business and might be favourably disposed to off-loading the Suirway Farm Machinery business at a reasonable price. Following the usual Morrissey haggling, an acceptable outcome was achieved. This was financed from the proceeds of the sale of Edward Dowley & Sons Ltd. (all of Willie Morrissey’s and most of mine). The initial directors were William Morrissey, Tom Power, Raymond Metcalfe and Leslie Dowley.

The business was carried out successfully at the original Head Office of Edward Dowley & Sons Ltd. in New St. for four years. However, increasing sales led to a requirement for a larger premises with proper showrooms and forecourt. In 1979, New St. was sold and the business relocated to a purpose built new premises on the Pill Rd. (opposite the entrance to Tinvane). At this point Tom Morrissey (Willie’s only son) joined the staff of Suirway Farm Machinery. Sometime later, Tom Morrissey joined the board of directors of Suirway Farm Machinery. This coincided with the company’s first venture in the leasing and sale of forklifts. In 1994 when Willie Morrissey was 83 years old and Tom Power had also reached retirement age, a decision to sell the company was considered appropriate as Tom Morrissey was not interested in operating the business on his own. In 1995, Suirway Farm Machinery Ltd. was sold and three years later Willie Morrissey died aged 87. Tom Morrissey reverted to farming in Knockroe, Co. Kilkenny, which was always his preferred vocation.

The new premises of Suirway Farm Machinery on the Pill Rd. Opened in January 1979 (Photo 1979)

The forecourt with trees on the avenue of Tinvane in the background (1979)

Suirway Forklifts Ltd

The increase in the materials handling business on and off the farm led to the increased use of forklifts. Suirway Farm Machinery Ltd. opened a subsidiary company known as Suirway Forklifts Ltd. to cater for this business. This venture became very successful. This success interfered with the core business of Suirway Farm Machinery and a decision was taken by the board of directors to sell off this part of the business. The business was sold to Robert Burke of Euroforklift in 1990. Euroforklift was later involved in a major financial scandal for double leasing of the same forklifts.

Willie Morrissey (MD Suirway Farm Machinery) being congratulated by Massey Ferguson manager on the occasion of the official opening (photo 1979)

Leslie J. Dowley

lesdowley@eircom.net

we have been totally absorbed by this family and business history and many compliments to you on this super achievement.

Hi I was at school with Erika Dowley Roberta Dowley Deirdre Montgomery and Averil Magnier for bout two years all lovely girls why am I thinking there was a connection to a Blaque family ??

Hi interesting article. I’m interested in a small part of it the Tannery factory in Portlaw which you say was amalgamated into a group of four local tanneries. I had an Uncle who worked there for 44 years. Seemingly he and most of the work force paid into a pension scheme which did not exist (that is what his wife – now 96 believe). It might be that her recall is faulty. I understand compensation was eventually given. Do you know anything about this part of the organisations history?